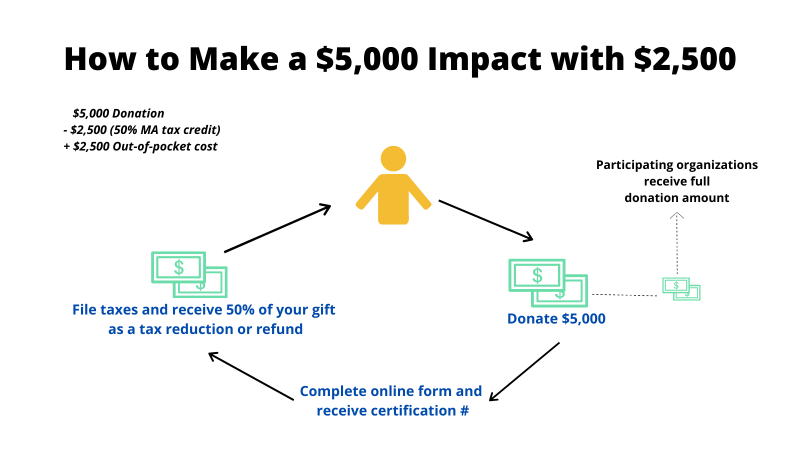

The Community Investment Tax Credit (CITC) provides a 50% tax credit against Commonwealth of Massachusetts tax liability. The CITC program is a refundable tax credit.

- CITC Investment Dashboard

- Go to the Commonwealth of Massachusetts CITC webpage

Donors will invest in a CDC's Community Investment Plan i.e. a CDC business plan, providing flexible working capital that can be used to seed new programs, fill funding gaps and leverage other resources. If the donor does not have sufficient tax liability, the credit is refundable, whereby the Commonwealth will issue a check for the balance of the credit to the donor. The minimum donation each year is $1,000.

Benefits:

- Considerable Tax Savings

- Individuals and Corporations can take advantage of tax credit

- Excess tax credit is refundable